Tax return depreciation calculator

First one can choose the. Calculating Depreciation In Rental Property.

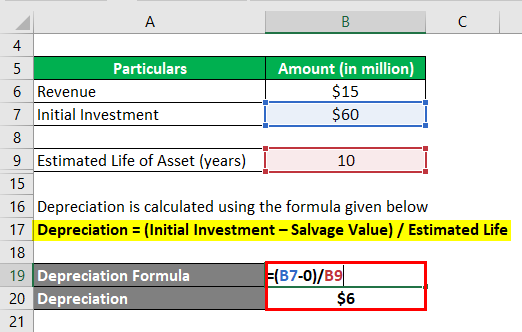

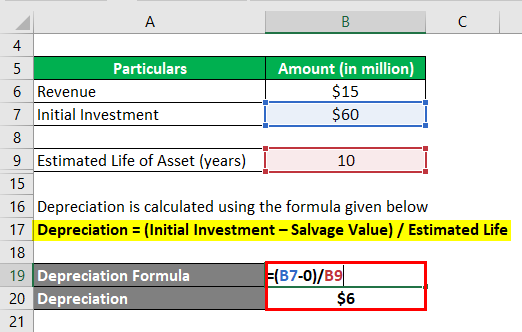

Depreciation Formula Calculate Depreciation Expense

First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred.

. Then this Macrs depreciation calculator will help you calculate the cost of the portion of every year. A Tax Depreciation Schedule is prepared by a qualified Quantity Surveyor who calculates the available deductions for the property. All you need to do is input basic information like your.

This depreciation calculator is for calculating the depreciation schedule of an asset. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. The calculator makes this calculation of course Asset Being Depreciated -.

If the computer has a residual value in 3 years of 200 then depreciation would be calculated. You calculate depreciation as follows. 35000 - 10000 5 5000.

MACRS depreciation calculator is used to calculating tax deductions. By using the formula for the straight-line method the annual depreciation is calculated as. The computer will be depreciated at 33333 per year for 3 years 1000 3 years.

For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service for the entire year. Cost of the Building - Value of the Land Building Value. You bought the property 250000 and 200000 of that was the value of the building rather than the land.

This means the van depreciates at a rate of. You are provided with a Tax Depreciation Schedule that. The MACRS Depreciation Calculator uses the following basic formula.

Every American has to file. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. Depreciation is allowable as expense in Income Tax Act 1961 on basis of block of assets on Written Down Value WDV method.

How to calculate the tax payable on Pension Provident or Retirement Annuity Fund. Note that this figure is essentially equivalent to. The computer will be depreciated at 33333 per year for 3 years 1000 3 years.

If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. This formula is used to calculate depreciation. Depreciation on Straight Line Method SLM is not.

Building Value 275 Yearly allowable. By using the formula for the straight-line method the annual depreciation is calculated as. It provides a couple different methods of depreciation.

The Tax Depreciation Calculators objective is to provide the property investor an indicative estimate of the tax depreciation deductions applicable on certain properties. How to calculate what your Tax Refund will be when you submit your tax return to SARS Tax Refund. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1.

35000 - 10000 5. The tool includes updates to reflect tax depreciation. To determine the amount youll be taxed on your depreciation recapture use our depreciation recapture tax calculator.

Looking at the depreciation table in Publication 946 the rate shows as 1819 for an asset placed into service in the 4th month which would give you 2547 in depreciation.

Depreciation Schedule Template For Straight Line And Declining Balance

Accounting Rate Of Return Formula Examples With Excel Template

Depreciation Macrs Youtube

/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator With Formula Nerd Counter

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Using Spreadsheets For Finance How To Calculate Depreciation

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator Irs Publication 946

Free Macrs Depreciation Calculator For Excel

How To Use Rental Property Depreciation To Your Advantage

Macrs Depreciation Calculator Straight Line Double Declining

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Guide To The Macrs Depreciation Method Chamber Of Commerce

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker